Author: admin

Unlock Your Cash Flow with Accounts Receivable Factoring

Are slow-paying customers impacting your cash flow and hindering your business growth? If yes then accounts receivables factoring, has got your back. It’s your best solution for your financial challenges. By converting your outstanding invoices into immediate cash, you can keep your operations running smoothly and focus on growing your business. What is accounting receivable […]

Read moreEnhance Your Cash Flow with Freight Bill Factoring

Is your trucking company struggling with slow-paying customers and cash flow challenges? If yes, then Freight bill factoring could be the game changer that you need. Just think about turning your freight wheels into immediate cash, ensuring your business runs smoothly without the stress of waiting for customer payments. With freight bill factoring you can […]

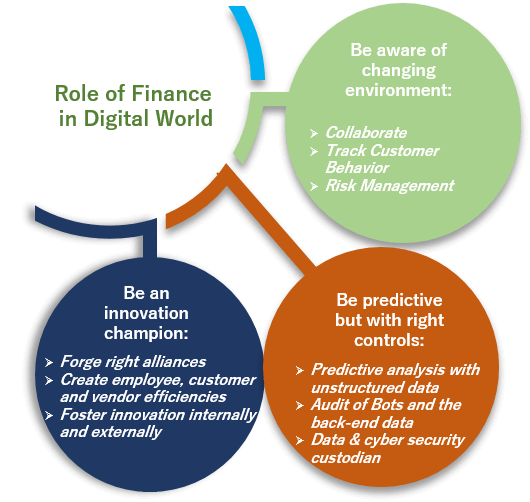

Read moreGreater Financial Role Played by the Factoring Company

This kind of expert factoring will offer impressive benefits both for the business and for the individual in terms of finance and for the organization. Factor invoice freight company are doing the job brilliantly and they make cash flow financing flexible. Factoring will allow for selling the accounts receivable and obtaining liquidity quicker. In addition […]

Read moreHow to use invoice factoring to attract the best labor talent?

Introduction Invoice factoring seems to be a prevalent source of funding for businesses that need to start raising working capital, speed up business expansion, start hiring talent, or purchase new equipment. This tactic can pay off for businesses of all sizes looking for a substitute for financial institutions. When banks are unable to provide funding […]

Read moreHow to improve the cash flow of your small business with the help of factoring?

Sales can be extended by extending credit, but you cannot forget your cash needs while waiting on your customer’s payments. You need cash for the inventory needs and to pay the employees’ salaries on time. A widely used method is Freight invoice factoring to maintain the cash flow. Now you might be wondering what freight […]

Read moreWHAT IS OILFIELD SERVICES FACTORING?

Immediately increase working capital and stop waiting 30 to 60 days to get paid for the oilfield services you have already provided your customers. Waiting to get paid can get your cash flow in a crunch, especally true for the new companies providing oilfield services. Invoice factoring is a simple, fast, easy to use funding […]

Read moreHOW CAN FREIGHT BILL FACTORING HELP MY TRUCKING BUSINESS?

Is your trucking company experiencing growth? Factoring invoices is a trusted, commonly used cash flow tool to keep your business expanding. Trucking requires major cash expenses and freight bill factoring provides increased cash flow. Factoring your freight bills is often times cheaper than taking quick pay offers and provides quick cash at a lower cost. […]

Read moreTOP TEN REASONS FOR USING FACTORING ACCOUNTS RECEIVABLES

These days most corporation houses know about factoring. But the question that is raised is whether or not you understand how you can use factoring to improve your business? Why you should think about factoring invoices? How much money you will get by factoring accounts receivables? Regardless to say one of the most crucial and […]

Read moreHOW TO FACTOR YOUR INVOICES TO THE RIGHT FACTORING COMPANY

Choosing a factoring company is not something that can be done easily and quickly or without careful attention. As factoring involves your present and future cash flow, the factor you select to work with will surely affect your business for many years to come. New factor companies are popping up all over the net and […]

Read more